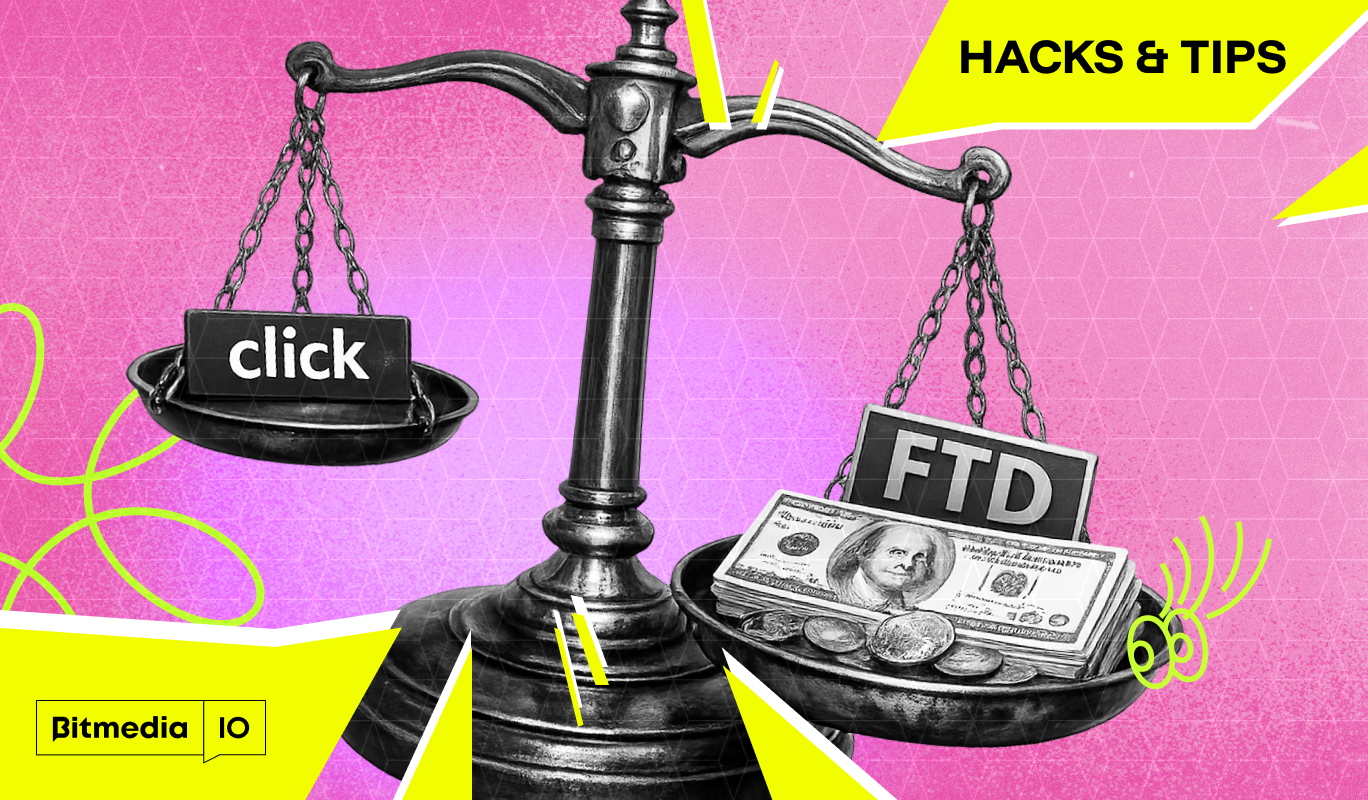

Why first-time deposits (FTDs) matter more than clicks in crypto campaigns

In 2026, the crypto advertising market is very competitive, and the old appeal of high click-through rates (CTRs) is fading. As the market matures, advertisers are shifting away from the trap of fleeting clicks behind. Instead, they are focusing on one specific metric: First-Time Deposits (FTDs). This shift redefines how advertisers evaluate growth. In a changing world that values privacy above all else, capital commitment provides the true benchmark for acquisition.

Clicks vs. first-time deposits explained

Clicks tell you how many people clicked an ad for the first time. Most of the time, when someone clicks on a link, they go to an app store, a landing page, or an exchange platform. Clicks primarily drive brand awareness and direct traffic to landing pages.

First-Time Deposits (FTDs) is a conversion metric that shows that a new user has successfully transferred their first funds or cryptocurrency into an account. A first-time deposit (FTD) is a big financial commitment to the service or platform.

People visit your site, but first-time deposits (FTDs) bring in money and possible lifetime value (LTV). FTDs are much more reliable than clicks because they are based on real financial transactions and internal ledger data. Accidental taps or even fraud can make clicks look bigger.

Why clicks often fail to reflect real demand

Clicks often don’t accurately show real market demand because of a combination of systemic problems, such as automated fraud and strange psychological behaviors in the blockchain space.

- Bot traffic and ad fraud: By early 2026, advertisers should expect to lose about $63 billion a year to invalid traffic, which includes bot clicks and fake engagement. PPC Shield says that advanced humanoid bots that act like people by scrolling and hovering over pages can eat up 25% to 40% of digital ad budgets in the crypto sector. This makes it hard for regular filters to find them. Bots clicking on things makes the CTR go up. This makes automated bidding algorithms wrongly favor low-quality sources, which wastes money on campaigns that are rigged.

- Low-intent and curiosity clicks: People who use cryptocurrencies are naturally curious about new technologies or flashy promises, which can lead to clicks that don’t have any commercial intent. People may click on ads that are hard to understand or use clickbait because they are curious, not because they want to do business. People who click on informational keywords like “what is DeFi?” are doing research at an early stage. People who click on transactional keywords like “buy ETH” or “wallet migration” are very different from these people. These keywords show high-intent urgency.

- Misleading CTR performance: A high CTR can, oddly enough, hide big problems with a campaign’s funnel. A campaign might bring in 100,000 visitors, but if only 0.01% of them connect their wallets, the traffic isn’t worth anything for making money. People who already use the service often click on paid ads to log in faster. These clicks are counted as successful engagements, but they don’t show that demand is growing or that there is more of it. A 2% CTR alone doesn’t mean anything. It’s just a way to see if the creative message fits.

What first-time deposits reveal about user intent

A user trusts the platform and knows their money won’t disappear when they make their first deposit. Trust is a key factor that sets viewers apart from depositors. Also, successfully going through the Know Your Customer (KYC) process, which is known to be very hard in the world of cryptocurrency, and then putting money in shows that you really want to use the platform for a long time.

The user’s willingness to pay transaction costs, such as gas fees or regular bank fees, shows that they think the product is worth more than the initial investment. This shows that you are clearly ready to get involved in the crypto world.

On-chain activity related to the deposit is an indicator of how likely users are to stay with the product in the future. A user who does FTD is much more likely to become a loyal customer. This means that they are really interested in the product and not just curious.

Impact of FTD-focused campaigns on ROI

Optimizing for first-time deposits directly enhances campaign economics. A good funnel that focuses on FTDs saves a lot of money that would have been wasted on bots and people who aren’t using the site. In 2026, algorithms will bid on the intention of ads to show them to people who are actually interested in them, not just people who click on them. This means that advertisers only have to pay for users who are very likely to make a deposit, which makes every dollar spent much more effective.

FTD is a long-term way to make money. Campaigns that focus on deposits naturally draw in serious investors with big budgets, usually between $5,000 and $10,000 a month. This greatly raises the average return per user (ARPU). A user who gets past the initial deposit barrier has a much higher retention rate, which will help the projected average return per crypto user reach new highs in 2026.

FTDs help advertisers set a high bar for Marketing ROI, and campaigns that get 5:1 results are a clear sign of success. This method puts making money in a way that lasts longer than short-term traffic spikes first. It doesn’t pay attention to vanity metrics and instead focuses only on real business results.

How advertisers can optimize for FTDs instead of clicks

You should stop using broad-stroke campaigns and start using very specific ones that make it easier for more people to make their first deposit:

- Intent-based targeting and on-chain data: Regular targeting based on demographics isn’t enough. Blockchain-Ads and other new crypto tools help you find wallets and make lookalike audiences based on people who are currently making high-value deposits. Long-tail keywords like “safe crypto exchange for beginners” get a lot of search queries that are looking for something specific. They also avoid broad and expensive terms like “cryptocurrencies.”

- Conversion-focused funnel design: High-converting funnels remove friction to guarantee a seamless transition for the depositor. This includes giving educational content in the middle of the funnel to build trust, making onboarding easy with semi-automated KYC/AML processes, and using urgency and incentives like first deposit bonuses that are only available for a limited time or tiered reward programs to get people to act right away.

- Advanced attribution models: Using last-click models makes the last touchpoint seem bigger than it is. Advertisers should use position-based (U-shaped) or data-driven/algorithmic attribution models that give credit for the whole customer journey. Tracking on the server side makes sure that data is collected more accurately.

- Publisher selection: The quality of the ad space has a direct impact on the deposit rate. You can improve your reputation by working with crypto-native networks like Bitmedia, Coinzilla, and Cointraffic or by joining niche communities on sites like Reddit, Telegram, and Discord. Users feel more sure and less unsure about making a deposit when they work with well-known crypto news sites like CoinDesk.

The true measure of crypto success

The reliance on click-through rates (CTRs) is diminishing in favor of deterministic data and verified user outcomes. While clicks remain a standard metric for brand awareness and top-of-funnel reach, agencies like Thrive now categorize them as secondary signals compared to Cost Per Acquisition (CPA) and customer lifetime value. First-Time Deposits (FTDs) are now the best way to show interest, trust, commitment, and real financial involvement. Performance-focused marketers often prioritize First-Time Deposits (FTDs) as a high-intent signal, as clicks can be more susceptible to bot-driven inflation than verified financial transactions. Focusing on FTD-based optimization aligns marketing spend with actual capital commitment, potentially reducing the waste associated with non-converting bot traffic.