AI-powered ad networks in crypto – weapon or risk?

Have you seen Coca-Cola’s AI-generated ads? Similar things are now appearing in crypto marketing as well.

For some people, AI is worthless and too easy to spot. For others, it’s a tool that saves massive human effort and can dramatically increase clicks, leads, and conversions. A good example is Headway, a Ukrainian edtech startup that boosted its ad performance by 40% using AI tools like Midjourney and HeyGen.

So what exactly is AI in digital advertising? A secret weapon against competitors, or a major risk that could lead to fines and bans? Let’s break it down in this article.

Also, we’ll explore how to use AI in marketing and advertising, which crypto ad networks are already mastering automated ad targeting, and what risks and ethical challenges come with all of this.

The expansion of AI in crypto advertising

AI has spread into every part of life, and of course, it has reached crypto, too. For example, Kalshi, a financial exchange, produced a fully generative AI ad aired during the NBA Finals. They used tools like Google’s Veo 3, ChatGPT, Runway, and ElevenLabs. The 30-second spot included an AI-generated script, visuals, and voiceover, and cost under $2,000.

AI advertising tools are used together with machine-learning systems and predictive analytics. Machine-learning systems process massive amounts of data: wallet activity, trading frequency, token balances, and based on it, build detailed profiles of crypto users.

The old Web2-style demographic targeting sounded like “this person is a 25-year-old male from Europe.” But now, AI produces something far more behavior-based: “This user is a long-term ETH holder who stakes regularly and swaps tokens when gas fees drop.”

In turn, predictive analytics tries to guess what you’ll do next. These systems analyze your past behavior and attempt to predict your next move.

For example, if you’ve been reading yield-farming guides at 2 a.m., chances are you’ll start seeing ads for DeFi platforms offering staking rewards.

Combining these tools gives AI marketing some undeniable advantages:

- 24/7 optimization: AI monitors markets, time zones, and token movements around the clock and automatically shifts budgets to where conversions are highest.

- Anti-fraud: according to TrafficGuard, advertisers waste 26% of their advertising budgets on ad fraud. This is where AI becomes especially useful, as it can flag suspicious activity instantly.

- Reading sentiment: a tool scans social media and news to detect mood shifts. After a hack or bad headline, it pauses promotions; when hype builds, it ramps them up.

- Tracking the user journey: it combines an ad click on X, a CoinGecko check, a Discord discussion, and an on-chain transaction into one full user path to reveal what truly drives conversions.

- Automated creative testing: no more torturing marketers to produce endless variations. AI tests and generates new creatives on the fly. Tools like Zeely can deliver hundreds of high-performing ad versions and launch them instantly.

AI-powered ad networks in crypto

The potential of AI in advertising and your profit potential along with it keep growing every year. That’s why it’s better to rely on professionals who know what they’re doing. They understand how to use it correctly, so nothing gets ruined, and you don’t end up redoing everything after it.

Bitmedia, founded in 2014, is an old-school player. It uses machine learning for bid optimization and fraud prevention. It analyzes traffic to spot bots and predict the best placements.

Coinzilla goes big on data. Its AI studies device types, browsing patterns, and timing to predict who’s most likely to click, constantly testing visuals and copy. Neural networks forecast results before launch and even suggest budget splits.

Ambire (AdEx) adds decentralization. Built on blockchain, it logs every impression through smart contracts for full transparency.

A-ADS places a strong emphasis on privacy. Its AI avoids tracking, using contextual targeting instead. Less precise, but more ethical.

Blockchain-Ads runs real-time bidding, tracks sentiment, and even detects whale activity.

Some newer on-chain networks like Persona let advertisers target users by verified blockchain behavior without revealing identities. For example, active NFT minters. It’s promising, but still experimental.

The hidden risks of AI-driven ad networks

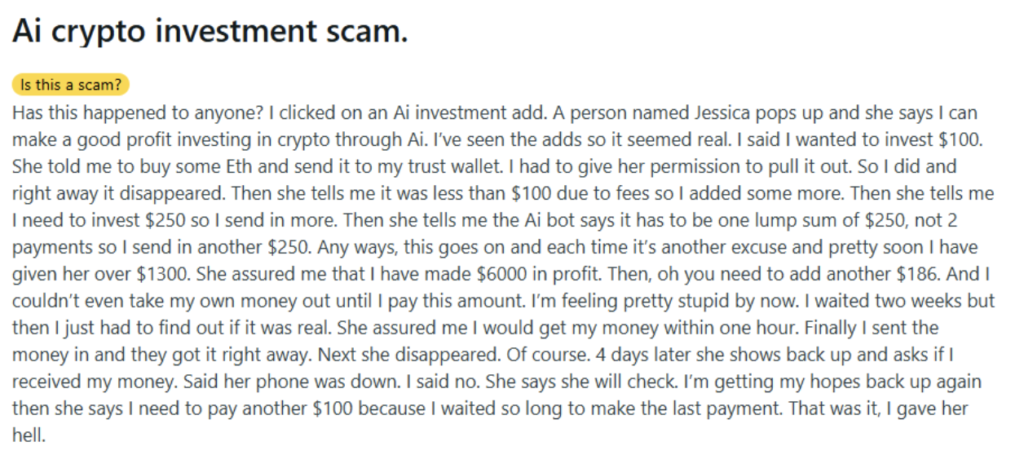

In a market already full of scams and big swings, letting AI take over can easily backfire. Here are the risks that using AI in advertising can bring:

- Most AI ad platforms don’t show their work. Budgets jump, targeting shifts, placements change, and the only explanation you get is “the algorithm optimized.” That’s fine until your campaign lands next to a scam token or on a junk site, and you can’t prove how it happened.

- Bad actors run AI agents that mimic real people with realistic session times, human-like clicks, and even wallets with believable histories. They adapt in real time to the very defenses meant to stop them.

- AI connects wallet data, browsing history, and social activity into full user profiles. “Anonymous” users end up fully mapped, and one data leak could expose their entire financial footprint.

- If past users from certain groups clicked less, AI may quietly stop showing them ads at all.

Ethical and regulatory challenges

AI and crypto advertising move faster than current laws to keep up. If something goes wrong, the excuse “the algorithm did it” won’t cut it as an excuse.

Some AIs amplify influencer posts without consent or create fake testimonials entirely. The U.S. Federal Trade Commission (FTC) clearly states that undisclosed fake testimonials are deceptive and illegal, with civil penalties up to $51,744 per violation in some recent cases.

AI doesn’t recognize borders or new laws, so it surely brings regulatory issues. In 2022, the UK’s Advertising Standards Authority (ASA) flagged over 50 companies for slow compliance with new crypto ad rules. However, from October 2023 to October 2024, only 54% of the FCA’s alerts resulted in illegal crypto ads, apps, or websites being removed, the Financial Times reports.

Generative AI can insert into crypto projects ads phrases like “passive income” or “projected returns” which make them look like securities. They are heavily regulated by financial authorities like the U.S. SEC. Ads suggesting “passive income” or promising “projected returns” can imply that the token is an investment contract or security.

It can also break GDPR rules. AI ad systems process wallet activity, transactions, and behavior, and collect far more information than necessary.

It’s surprising, but even Google and Meta’s AI systems also make mistakes. They often mislabel really compliant campaigns. For example, it tags wallet promos as “investments” and leads to policy violations and bans.

Meta adds to the confusion by raising rates for accounts it suspects of fraud. It lets some risky artificial intelligence ads slip through and block real projects.

Finding the Balance: Human Oversight + AI in Crypto Ads

The idea of just writing the perfect prompt for AI and chilling is tempting. But considering the massive fines and lawsuits that can follow an AI mistake, you’ll still have to keep things under control.

So, what exactly should you do?

- Use explainable AI. From the start, choose models that show why decisions are made. If using black-box systems, start in “shadow mode” before full rollout.

- Carefully refine your main prompt. Define brand voice, audience limits, and legal red lines before hitting “auto.” Let AI handle bids, pacing, and creative tests within those guardrails.

- Add safety stop mechanisms. Pause when spending spikes, new geos appear, or audience mix looks off.

- If it isn’t written down, it doesn’t exist. Keep logs of key decisions and outcomes. Feed real feedback back into models as markets and rules evolve.

Yes, AI can do amazing things. But our job as marketers is to make sure it doesn’t go off the rails. Let it handle what it does best while we stay responsible for strategy and brand. AI can be the engine, but we should remain the driver.