The future of Real-Time Bidding (RTB) in crypto advertising

The crypto industry rapidly adopted advanced digital marketing techniques from its inception. Crypto projects, driven by the need to engage a global audience and achieve specific performance metrics, swiftly embraced automated advertising purchases.

The first, unregulated phase of crypto advertising is likely to end in 2026. Changes in how ad impressions are bought and sold are being forced by new Web3 technology and strict rules about data privacy. Advertisers must recognize that RTB is evolving beyond a mere traffic-driving mechanism to stay competitive. It is transforming into a precise method for acquiring audiences through verifiable data signals that demonstrate high intent.

This article explores the future of RTB in crypto advertising, the drivers behind its evolution, and its significance for anyone involved in buying or selling crypto ads.

What is RTB?

Real-time bidding (RTB) is a fast, automated way to buy and sell digital advertising inventory. When someone goes to a website or opens a mobile app, and there is an ad slot open, a bid request is sent. This request sends potential buyers information about the page’s content, the user’s general location, and the type of device they are using in less than a second.

In the crypto industry, real-time bidding marketing is currently done in a certain order. A user going to a crypto news site or a DeFi tracking dashboard is the first step in the process. The publisher’s Supply-Side Platform (SSP) sends a request to different ad exchanges right away. During the auction phase, crypto advertisers use Demand-Side Platforms (DSP) to check the request with algorithms. These systems check to see if the impression fits certain target criteria, like verified Bitcoin holders or active NFT collectors.

Brock Munro, Head of Product & Yield at Publift, explains,

“The introduction of real-time bidding to the ad tech industry has significantly changed the way publishers monetize, creating both opportunities and challenges for yield optimization.”

The main idea behind RTB is this quick, impression-level value. RTB is different from traditional bulk ad buys because it sets the price for each ad placement based on its value at that exact moment.

Is RTB the same as programmatic advertising?

Many often conflate RTB with programmatic advertising. While similar, they are not identical. Programmatic advertising is the operating system, which is the big picture that uses software to make buying and selling media easier. It has a lot of different ways to do things, like programmatic, direct, and private marketplaces.

Real-time bidding advertising, conversely, is a specific application or component within that system. While programmatic advertising can function independently of RTB, for instance, through automated pre-negotiated fixed-price deals, RTB is inherently programmatic. This distinction is crucial for crypto advertising platforms: RTB offers superior flexibility and broader reach on the open web, yet it introduces distinct brand safety considerations compared to direct programmatic agreements.

What’s pushing RTB to change

The forces that are changing things can be unavoidable by 2026. Blockchain advertising stricter regulation is the main reason. The Digital Services Act and the Data Act (DAA) are now being enforced by the government. Regulatory bodies such as the FTC and the European Data Protection Board are specifically scrutinizing real-time bidding auctions for data arbitrage, which is the practice of broadcasting user data to bidders without verifiable consent.

Second, the industry is having trouble with signal loss, which is getting worse because Google has promised to add a privacy control that stops cookie matching and takes encrypted User IDs out of the real-time bidding stack. For crypto advertisers, this means that old ways of tracking are no longer useful, which makes the shift to first-party and on-chain data even more important.

Finally, the market demands greater transparency and efficiency. Advertisers are no longer tolerating the high rates of ad fraud once prevalent in the industry. This necessitates RTB advertising models that maintain clear, immutable records of ad placements and ensure every dollar spent reaches a genuine human audience.

On-chain data and RTB

The exciting change in Web3 advertising is the addition of on-chain data to the bidding stack. In 2026, public ledgers like Ethereum, Solana, and Layer 2s give us a ground truth that regular cookies never could.

We can now use on-chain data instead of trying to guess a user’s interests based on their browsing history:

- Economic weighting: Advertisers can raise bids for wallets that have a certain amount of stablecoins or certain high-value NFTs.

- Real-time intent: A bid can be started when a user moves assets to a new protocol or interacts with a DeFi staking contract.

- Verifiable identity: On-chain transactions cost money (gas fees), which makes them a natural filter. Now, bidding algorithms prioritize addresses with a history of real economic activity over empty wallets that appear to be bots.

Advertisers no longer guess what users are interested in based on their browsing history. Instead, they use verifiable on-chain data to find out exactly what economic actions and assets are in a wallet.

RTB vs. programmatic direct in crypto ads

Advertisers must think about the pros and cons of the open auction and programmatic direct when choosing between real-time bidding platforms.

- RTB (the open auction): This is the best way to reach a lot of people and retarget them. It has dynamic pricing, which means that the market sets the price of each impression. This is the quickest way to launch a global campaign, but you need to do a lot of filtering to make sure your ad doesn’t show up on a site with low quality.

- Programmatic direct: This means talking directly to a publisher about a set price (CPM). It makes sure that your ad will show up on a certain crypto news site that people trust. It is the gold standard for launching a brand when brand safety is the most important thing.

- A hybrid model: It smartly mixes these two methods. Advertisers often use programmatic guaranteed deals to get premium, fixed-price spots on top-tier sites. At the same time, they use Private Marketplaces (PMPs) and Open Exchange Real-time bidding advertising to reach more people and improve performance. This all-in-one method makes sure that both brand authority and a wide market reach are achieved quickly.

Challenges RTB still faces in crypto advertising

Even with all the progress in technology, many problems persist today. RTB ad fraud and bot traffic continue to hinder ROI. PPC Shield reveals that 25-40% of digital ad budgets in the crypto niche are lost to advanced humanoid bots that act like real people.

Also, uncertainty about regulations is still causing problems. Different places have different rules about how to promote financial products, so a campaign that is legal in one place might get big fines in another. On top of that, there isn’t much standardization across different blockchains. It’s still hard to keep track of a user’s journey between using a Solana wallet and making a purchase on an Ethereum-based platform, and there are still gaps in the data.

Trust in advertisers is at an all-time low. For years, supply chains have been hard to understand. Now, crypto projects want reports that can be verified. They want to know exactly where their ads were shown and if real people saw them.

What the future RTB stack may look like

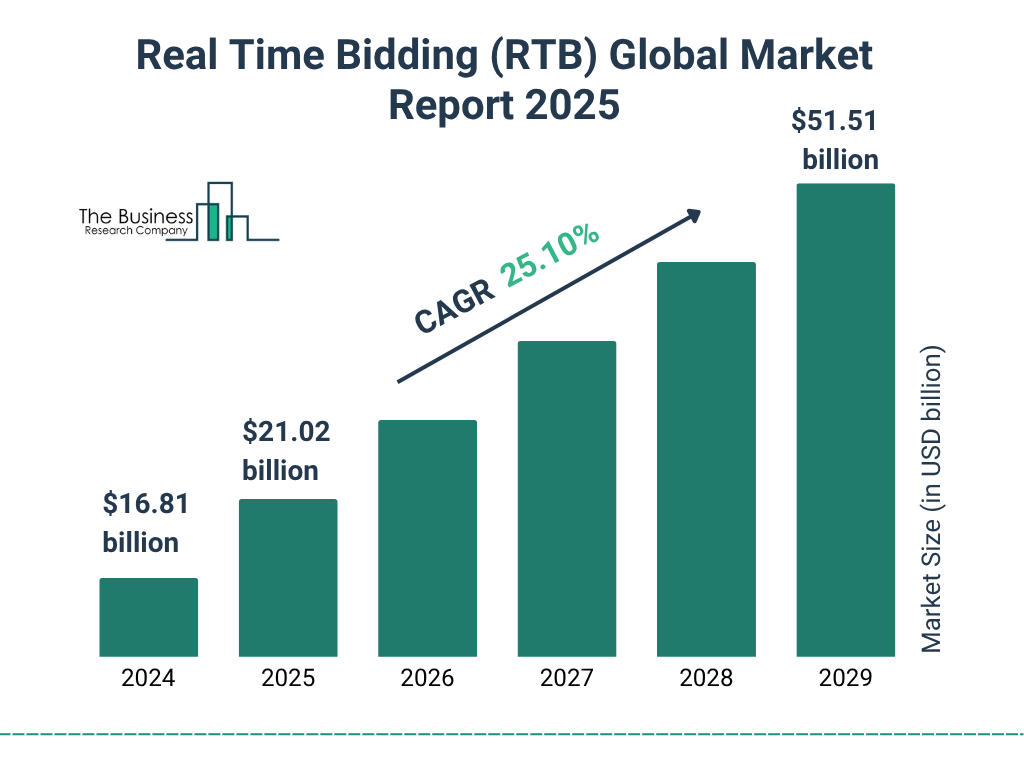

RTB Global Market Report Source: The Business Research Company

The future RTB advertising stack will be made up of parts that can be put together in different ways, be clear, and be controlled by the user. The RTB market is growing at an incredible rate right now. It was $16.81 billion in 2024, and reached $21.02 billion in 2025, thanks to the rise of mobile and connected TV advertising around the world. Even though the forecast was lowered by 0.1% because of rising international tariffs that affect data-driven efficiency, the market is still expected to reach a huge $51.51 billion by 2029, according to The Business Research Company.

Decentralized Identifiers (DIDs) are becoming more popular.

AI-powered automation will also be at the center of the stack. Predictive bidding before Dynamic Creative Optimization (DCO) will create thousands of ad variations in real time to fit the user’s current situation. Models will also predict how likely it is that a conversion will happen after a bid is placed. VertPro notes that this prevents over or underestimation, leading to more accurate budgets.

Blockchain for transparency will be the norm in business. We can get rid of the middleman tax and make sure that the advertiser gets exactly what they paid for by keeping track of the supply path of every impression on an unchangeable ledger. Smart contracts will eventually make the whole payment process automatic, only letting money go when a verified, human impression is confirmed.

Navigating the next era of crypto ad buying

Real-time bidding continues its evolution and refinement. The shift towards a structured and data-rich advertising environment is a significant advantage for those who prioritize transparency. As RTB transitions from invasive tracking to verifiable on-chain signals and AI-driven optimization, it is likely to remain the most potent tool in the crypto marketer’s arsenal.

As Web3 advertising grows, RTB is changing from a simple auction system. It is becoming a precise tool for making real, verifiable connections with the global crypto community. Its focus is now on high transparency and on-chain data signals to build trust and accountability.