Detailed Blockchain Analytics for Crypto Adoption

Blockchain technology has revolutionized the world of finance and given rise to cryptocurrencies. As the adoption of cryptocurrencies steadily gains momentum, the necessity of comprehensive blockchain analytics assumes paramount importance. Crypto adoption hit new heights in 2022, with 425 million crypto owners recorded, as per a report by Crypto.com.

According to another research, the trajectory of cryptocurrency adoption indicates a substantial surge in global crypto users. If current trends persist, the number of individuals engaging with cryptocurrencies is expected to surpass one billion by 2030.

The analytical approach enables us to derive valuable insights from blockchain data, facilitating informed decision-making and fostering the continued growth and development of this rapidly evolving ecosystem. In this article, we will explore the definition of blockchain analytics and its significance in cryptocurrency.

Definition of Blockchain Analytics

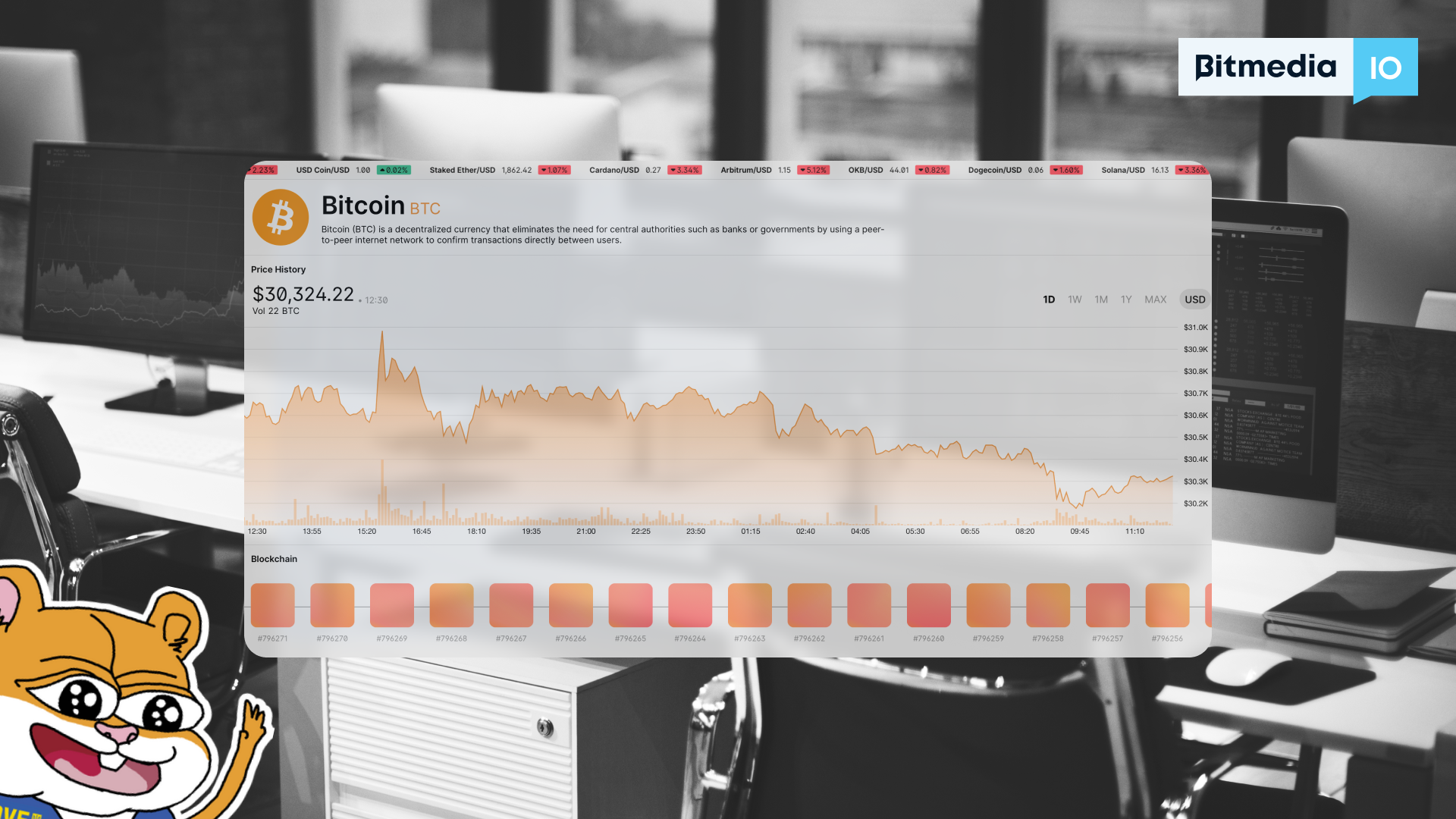

Blockchain analytics refers to the use of data analytics tools and techniques to gain insights and understand the transactions occurring on a blockchain network. It involves analyzing the data recorded on the blockchain, such as transaction details, addresses, and timestamps, to derive meaningful information and uncover patterns and relationships.

Importance of Analytics in Cryptocurrency

Analytics in the cryptocurrency space plays a crucial role in enhancing transparency, enabling regulatory compliance, and identifying potential risks and illicit activities. By leveraging advanced analytical tools, blockchain analytics provides a comprehensive understanding of cryptocurrency transactions, enabling stakeholders to make informed decisions and take necessary actions.

Understanding Blockchain Technology

History and Development of Blockchain

In 2008, an anonymous individual or group known as Satoshi Nakamoto unveiled a groundbreaking white paper that introduced the fundamental concepts underpinning the revolutionary technologies of Bitcoin and blockchain. Bitcoin’s underlying technology, the blockchain, is a decentralized and distributed ledger that records all transactions transparently and immutable.

Since then, blockchain technology has evolved and found applications beyond cryptocurrencies.

Image Source: Intellipaat

It has become a fundamental technology for various industries, including supply chain management, healthcare, finance and others. The development of blockchain has paved the way for a new era of digital assets and decentralized systems.

How Blockchain Works

At its core, a blockchain is a chain of blocks, where each block contains a list of transactions. These transactions are verified by network participants, known as miners, through a process called consensus. Once verified, the block is added to the existing chain, creating a permanent record of all transactions.

Blockchain operates on the principles of decentralization, immutability, and transparency. It eliminates the need for intermediaries, such as banks, by allowing participants to transact directly with each other. The decentralized nature of blockchain ensures that no single entity has control over the network, enhancing security and resilience.

The Role of Blockchain in Cryptocurrency

Cryptocurrencies, such as Bitcoin and Ethereum, rely on blockchain technology as the underlying infrastructure. Blockchain provides a secure and transparent platform for conducting cryptocurrency transactions. Every transaction is recorded on the blockchain, allowing users to verify the authenticity and integrity of the digital assets.

Blockchain technology enables key features of cryptocurrencies, such as decentralization, peer-to-peer transactions, and immutability. It ensures that transactions are secure, tamper-proof, and resistant to censorship. Moreover, blockchain allows for the creation of smart contracts, self-executing agreements that automatically execute predefined conditions once met.

Why is Analytics Important for Blockchain?

Enhancing Security through Analysis

The decentralized nature of blockchain technology provides inherent security benefits. However, analytics further strengthens cryptocurrency blockchain security measures by enabling the detection and prevention of potential threats.

Blockchain analytics tools can detect anomalies in transaction patterns, such as large transfers or multiple transactions from a single address, which may indicate a security breach or unauthorized access. Additionally, analyzing the behavior of nodes and miners on the blockchain can help identify potential attacks, such as double-spending or 51% attacks, and prompt timely responses to mitigate risks.

Monitoring Transactions and Wallets

One of the key use cases of blockchain analytics is monitoring transactions and wallets. With the help of analytics, it is possible to analyze transactional patterns and trace the flow of funds between different addresses.

By monitoring transactions and wallets, blockchain analytics can identify suspicious activities, such as money laundering, terrorist financing, or fraud. This capability is particularly relevant in the context of anti-money laundering (AML) and know-your-customer (KYC) regulations, where financial institutions and regulatory bodies need to ensure compliance and prevent illicit activities.

Improving Decision-Making for Investments

Blockchain analytics provides valuable insights for investors and market participants. By analyzing transaction volumes, market trends, and the activities of wallets, analytics tools can help assess the health and potential of different cryptocurrencies and blockchain projects.

Investors can make informed decisions based on data-driven analysis, such as identifying emerging trends, evaluating the liquidity of different assets, and assessing the risks associated with specific investments. These insights help investors navigate the dynamic and rapidly evolving cryptocurrency market and maximize their investment returns while minimizing risks.

Regulatory Compliance and Anti-Money Laundering (AML) Measures

Regulatory compliance is a critical aspect of the cryptocurrency ecosystem. Blockchain analytics plays a crucial role in ensuring compliance with regulations and implementing effective AML measures. By analyzing blockchain data, regulators can monitor transactions, detect suspicious activities, and enforce regulatory requirements.

Analyzing the flow of funds on the blockchain helps identify potential money laundering or terrorist financing activities. AML Blockchain analytics tools can track transactions across different addresses and detect patterns that deviate from normal behavior, raising red flags for further investigation.

Tools for Blockchain Analytics

Blockchain analytics tools play a crucial role in extracting meaningful information from blockchain data. With the right analytics tool, organizations can enhance security, monitor transactions, make informed investment decisions, and ensure compliance with regulatory frameworks.

Overview of Analytics Tools

In the realm of blockchain analytics, various tools have emerged to help organizations and individuals harness the power of data for insights and decision-making. These tools employ advanced algorithms and techniques to analyze blockchain data, providing valuable information about transactions, addresses, and entities involved in cryptocurrency networks.

Comparative Analysis of Popular Blockchain Analytics Tools

Chainalysis

Chainalysis, the leading blockchain analytics provider, offers a suite of powerful tools and services. Their software, Reactor, allows users to visually analyze intricate transaction networks across wallet addresses. By linking addresses to real-world identities, Reactor aids law enforcement in uncovering illicit activities such as darknet marketplaces and ransomware, as well as legitimate activities like mining pools and merchant services.

CipherTrace

CipherTrace focuses on providing solutions for anti-money laundering (AML) and financial crime prevention in the blockchain space. Leveraging CipherTrace’s data, their tool called Sentry enables seamless integration with your internal business systems, facilitating real-time monitoring for “know your transaction” purposes. This tool offer enhanced visibility into the flow of funds, allowing organizations to identify suspicious addresses and track the movement of cryptocurrency across different platforms.

Elliptic

Elliptic specializes in blockchain analytics and crypto-asset risk management. Elliptic’s cutting-edge software, Investigator, empowers businesses to ensure regulatory compliance and combat fraud by providing an intuitive graphical exploration of crypto wallets and their associated transactions. This comprehensive suite of crypto transaction and wallet screening tools aids businesses in upholding regulatory requirements while minimizing the risks of fraudulent activities.

Others

Apart from the aforementioned tools, there are several other notable players in the blockchain analytics space. Chainalysis, renowned as a prominent blockchain analytics provider, has traditionally held a dominant position in the market. However, the landscape has witnessed a recent surge in competition, with notable contenders emerging, including Elliptic, Nansen, and Coin Metrics. Each tool offers unique features and functionalities tailored to specific blockchain use cases, such as compliance, investigations, and risk assessment.

Source: Milkroad

How to Choose the Right Analytics Tool

When selecting a blockchain analytics tool, it is crucial to consider the specific needs and objectives of your organization. Here are some factors to consider:

- Use Case Alignment. Evaluate whether the tool aligns with your organization’s use case, such as compliance, risk management, or investigations.

- Data Coverage. Assess the tool’s ability to analyze data from various blockchain networks and cryptocurrencies. A comprehensive analytics tool should support multiple blockchains and provide coverage for the cryptocurrencies relevant to your operations.

- Feature Set. Examine the features and capabilities of the tool. Consider aspects such as transaction monitoring, address clustering, risk scoring, visualization, and integration options.

- Compliance and Regulations. Ensure that the tool incorporates regulatory requirements and provides functionalities to facilitate compliance with AML and other financial regulations.

- User-Friendliness. Consider the usability and user interface of the tool. It should provide a user-friendly experience, allowing non-technical users to leverage its capabilities effectively.

- Reputation and Support. Research the reputation of the analytics tool provider, including their track record, customer reviews, and support services. A reliable and reputable provider will offer ongoing support and updates to address evolving challenges in the blockchain landscape.

Organizations can select the ideal analytics tool by assessing factors and conducting research, enabling them to unlock valuable insights from blockchain data.

Real-world Use Cases of Blockchain Analytics in Crypto Adoption

Blockchain analytics has a wide range of real-world applications in fostering crypto adoption across various industries.

Improving Financial Services with Blockchain

Blockchain analytics has the potential to revolutionize various aspects of financial services. By leveraging analytics tools, financial institutions can enhance transaction monitoring, detect fraudulent activities, and ensure regulatory compliance. Analytics can provide insights into the flow of funds, identify suspicious patterns, and improve risk assessment for lending and investment decisions. Additionally, blockchain analytics can help streamline processes such as Know Your Customer (KYC) and Anti-Money Laundering (AML) procedures, reducing costs and increasing efficiency in the financial industry.

Facilitating Supply Chain Management

Blockchain technology has gained traction in supply chain management due to its ability to provide transparency, traceability, and immutability. By utilizing blockchain analytics, organizations can track and verify the movement of goods throughout the supply chain, ensuring authenticity and preventing counterfeiting. Analytics tools enable stakeholders to monitor transactions, validate the origin of products, and identify potential bottlenecks or inefficiencies. This improves trust and accountability among participants in the supply chain, enhancing overall efficiency and customer satisfaction.

Ensuring Authenticity in Collectibles and NFTs

The rise of non-fungible tokens (NFTs) has introduced new challenges in terms of verifying the authenticity and provenance of digital assets. Blockchain analytics can play a crucial role in validating NFTs by analyzing the underlying blockchain data. By examining the transaction history, ownership transfers, and smart contract interactions, analytics tools can help authenticate and validate the ownership and uniqueness of NFTs. This provides confidence to buyers, creators, and investors in the authenticity and value of digital collectibles.

Governance and Voting Systems

Blockchain-based governance and voting systems have the potential to increase transparency, security, and participation in decision-making processes. Blockchain analytics can ensure the integrity of such systems by monitoring transactions related to voting or governance activities. By analyzing the blockchain data, analytics tools can detect any anomalies or attempts at manipulation, safeguarding the democratic principles of these systems. This fosters trust and confidence in the governance processes and enables more inclusive and transparent decision-making.

Healthcare Records Management

The healthcare sector can benefit from the adoption of blockchain analytics for secure and efficient management of patient records. Blockchain technology provides a decentralized and immutable platform for storing and sharing healthcare data, ensuring privacy and data integrity. Analytics tools can help healthcare providers analyze patient data, identify trends, and improve medical research and treatment outcomes. By leveraging blockchain analytics, healthcare organizations can enhance data security, streamline operations, and enable interoperability among different stakeholders in the healthcare ecosystem.

The Future of Blockchain Analytics

As blockchain technology continues to mature and evolve, the importance of analytics in understanding, optimizing, and securing blockchain-based systems will continue to grow. By leveraging the power of analytics, organizations and individuals can unlock the full potential of blockchain, driving innovation, improving efficiency, and fostering trust in the digital economy.

Predictive Analysis and AI Integration

The future of blockchain analytics lies in the integration of predictive analysis and artificial intelligence (AI) technologies. By leveraging historical blockchain data and utilizing machine learning algorithms, analytics tools can identify patterns and trends that can help predict future market movements, investor behavior, and potential risks. Predictive analysis can assist in making informed investment decisions, detecting market trends, and mitigating potential risks. AI integration can enhance the efficiency and accuracy of blockchain analytics, enabling faster and more precise insights into blockchain data.

Combating Fraud and Financial Crimes

Blockchain analytics will continue to play a crucial role in combating fraud and financial crimes in the cryptocurrency space. As cryptocurrencies gain wider adoption, the risk of fraud and illicit activities increases. Analytics tools can monitor transactions, detect suspicious patterns, and identify potential money laundering activities. By analyzing the flow of funds and tracking the movement of cryptocurrencies, blockchain analytics can help law enforcement agencies and regulatory bodies investigate and prevent financial crimes. The integration of advanced analytics techniques, such as graph analysis and anomaly detection, will enhance the capabilities of blockchain analytics in identifying fraudulent activities.

The Role of Analytics in the Mass Adoption of Cryptocurrency

Blockchain analytics will play a vital role in driving the mass adoption of cryptocurrency. As individuals, businesses, and governments embrace cryptocurrencies, the need for robust analytics tools becomes imperative. Analytics can provide transparency, accountability, and security, which are crucial factors for building trust in cryptocurrencies. Furthermore, national cryptocurrencies emerge as a promising frontier in blockchain analytics development. These currencies grant users autonomy while enabling central banks to exercise analytics over the circulating supply.

Summary

In conclusion, blockchain analytics is a critical enabler of the crypto ecosystem. Its ability to provide transparency, improve security, and mitigate risks contributes to the overall growth and acceptance of cryptocurrencies. As the technology evolves and becomes more sophisticated, the role of analytics will continue to expand, fueling the adoption of cryptocurrencies and shaping the future of the digital economy.

- Recap of Blockchain Analytics

Blockchain analytics enables enhanced security through the identification of potential threats and vulnerabilities, monitoring transactions and wallets to ensure transparency and integrity, and improving decision-making processes for investments. It also plays a vital role in regulatory compliance, anti-money laundering measures, and combating financial crimes. Additionally, analytics tools provide real-world use cases in various sectors, such as financial services, supply chain management, collectibles, NFTs, governance, and healthcare records management.

- The Significance of Analytics in Fostering Crypto Adoption

The significance of blockchain analytics in fostering crypto adoption cannot be overstated. As cryptocurrencies continue to gain traction, analytics tools provide the necessary transparency, accountability, and security measures required for widespread adoption. They instill trust in the technology by addressing concerns related to fraud, money laundering, market manipulation, and regulatory compliance.

Analytics tools empower individuals and businesses to make informed decisions about cryptocurrency investments, navigate market trends, and identify potential risks. They also assist in creating a favorable environment for regulatory bodies to embrace cryptocurrencies, as analytics help ensure compliance with existing financial regulations.

Furthermore, the future of blockchain analytics holds promising developments, such as predictive analysis and AI integration, which will further enhance the capabilities of analytics tools. These advancements will enable more accurate predictions, proactive risk management, and a deeper understanding of market dynamics, ultimately fostering confidence and driving the mass adoption of cryptocurrencies.

Bitmedia.io is a leading company playing a vital role in blockchain adoption. Specializing in crypto advertising, it helps businesses promote their projects and products within the cryptocurrency ecosystem. By providing a reliable and efficient advertising platform, the company contributes to the wider adoption of cryptocurrencies by creating awareness, attracting new users, and fostering a thriving crypto economy. Bitmedia.io plays a crucial role in bridging the gap between businesses and potential crypto adopters, facilitating growth and innovation within the industry.

Choose Bitmedia!