Crypto in a recession – How startups are adapting in 2025

The cryptocurrency market emerged from the 2008 financial crisis. But as the world’s economy gets worse in 2025, with the constant fear of a recession and crypto markets being very similar to traditional risk assets, that safe place is being put to the test. On October 11, 2025, a combination of geopolitical shock and technical weakness caused the largest single-day crypto liquidation event in history, wiping out around $800 billion in market value. To make it through the crypto crisis, you need to quickly move away from the euphoric, spend-heavy growth models of the past and towards strategies that are lean, people-first, and focused on usefulness.

The global economic outlook in 2025

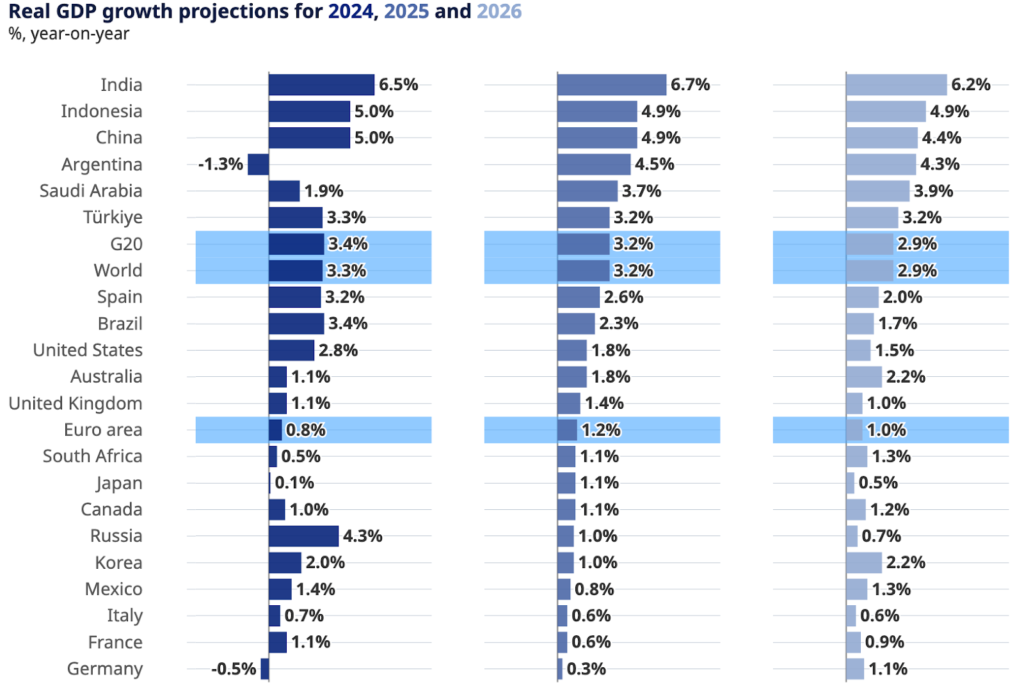

The IMF, World Bank, and OECD have all had a hand in shaping the global economic picture for 2025. It shows low growth, high inflation, and a lot of uncertainty because trade tensions are rising. This is a big problem for the crypto market.

Global growth is expected to be strong but below average, at 3.0% to 3.3%. There will be big differences between areas. The OECD says that the US economy will slow down substantially, to 1.8%, mostly because of increased tariffs and cuts to federal expenditure. This makes people worry about a recession and problems in the crypto market. China’s economy slows to about 4.9% because of tariffs and sluggish property markets, although this is balanced out by policy support. The Euro Area is still weak (1.0% – 1.2%), which is pushing the European Central Bank to lower rates.

Changes in technology and regulations are changing the way finance works. Institutions are quickly using AI and automation to be more efficient, which makes it hard for blockchain companies to keep up.

Impact of a recession on the crypto industry

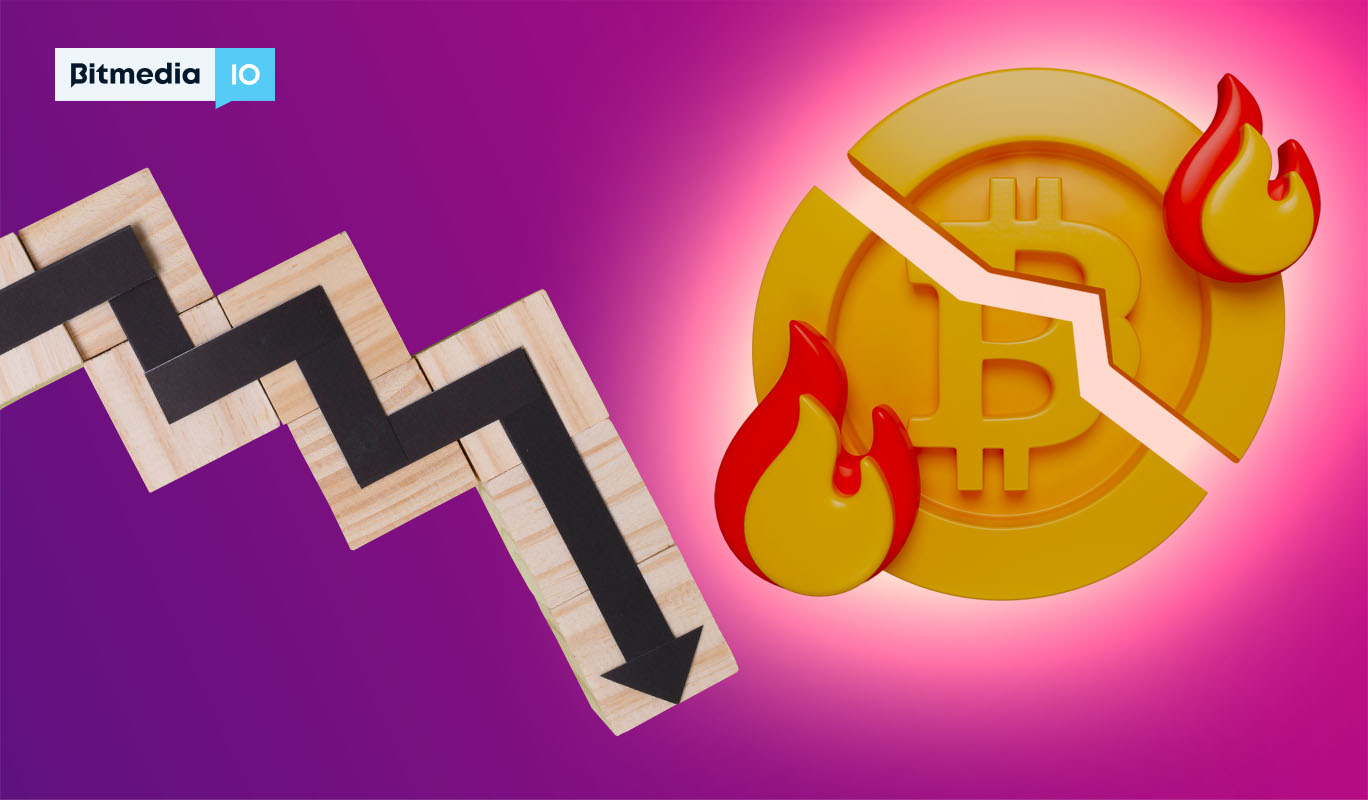

When the economy goes into a recession, the crypto market becomes unstable because investors switch to a “Risk-Off” mindset, moving away from speculative assets like cryptocurrency and focusing on liquidity.

Correlation with traditional markets, especially tech stocks, makes this effect even stronger. When the stock market goes down, it usually hurts the prices of cryptocurrencies. For example, Bitcoin lost 50% of its value in two days during the early COVID-19 collapse. Recent events show that this is true: When President Trump said that all Chinese imports would be subject to 100% tariffs on October 11, 2025, the market crashed right away. This shows how sensitive crypto is to political events. The downturn has a big effect on how the market works:

- Record liquidations. On October 11, 2025, more than $19 billion in leveraged positions were closed, affecting 1.6 million traders. Bitcoin momentarily reached $102,000, while many Altcoins lost more than 50% of their value.

- Leverage impact. People often sell their leveraged positions, which makes the price drop worse.

- Altcoin decline. Altcoin performance usually trails behind Bitcoin, the main indication, because Bitcoin usually does better than altcoins, which are more volatile and lost 80 – 90% of their value after the high in 2021.

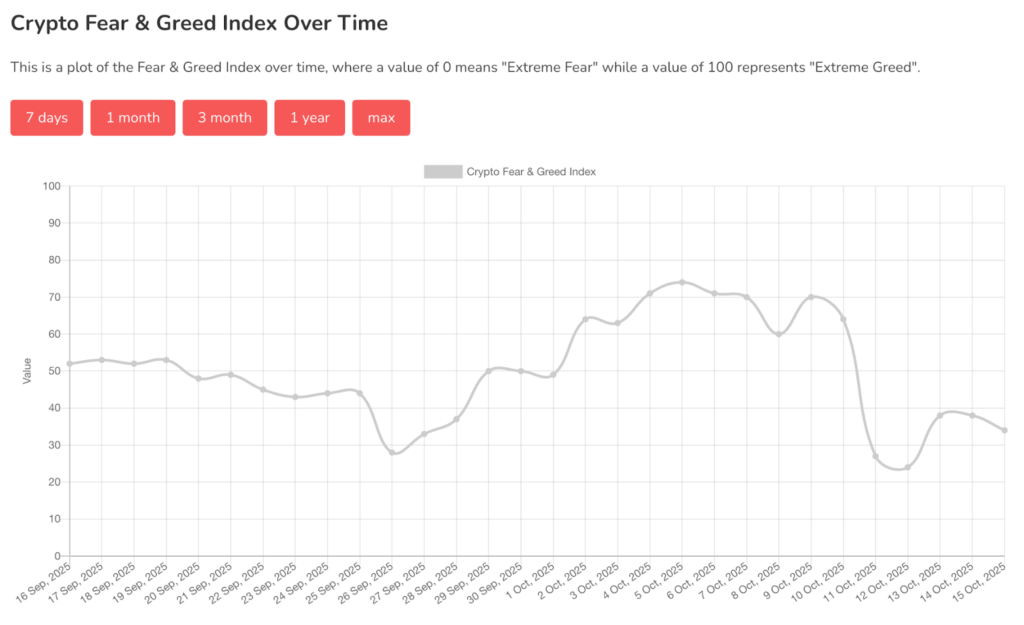

- Market sentiment. The Crypto Fear & Greed Index moved to “Extreme Fear” in October 2025 because of worries about the economy as a whole. This shows how quickly market mood can change.

- Systemic shocks. The Terra-LUNA and FTX crashes in 2022 were major internal shocks that showed how big the systemic risk is by wiping out hundreds of billions of dollars in value.

To stabilize economies, governments may boost Regulatory Scrutiny. This is hard, but in the end, it leads to stability and investor trust, which are both important for projects that follow the rules.

How crypto startups are adapting in 2025

In 2025, crypto startups are adapting to a more mature market by building sustainable business models centered on trust, transparency, and practical utility. Startups are very focused on apps that are really useful:

- Real-World Assets (RWA) and DeFi. There is a movement to turn traditional assets like real estate and bonds into tokens to make them easier to trade. At the same time, they’re working on DeFi platforms for decentralized lending and trading, focusing on cheaper fees to get more people to use them.

- AI and blockchain integration. This convergence leads to new ideas, such as using AI agents to get the most out of a situation and blockchain to build trust by checking the source of AI data.

- Prioritizing compliance. Startups go for places with clearer rules (like Switzerland and the UAE) and benefit from the U.S. government’s work on stablecoin frameworks and innovation exemptions. Well-defined rules are crucial for attracting established financial players and encouraging broader participation in the crypto economy.

- Scalability and UX. The technical focus is on improving modular structures, zero-knowledge proofs, and communication between chains. Innovations like account abstraction make it easier for people to use.

Venture Capital Trends favor companies that are further along and have proven revenue. The success of Bitcoin and Ethereum ETFs is making a lot of money available to both institutions and individuals.

Regulatory challenges and opportunities

The rules for crypto businesses in places like Switzerland, Singapore, and the UAE that are receptive to crypto will be both hard and very good in 2025.

The main problem is figuring out how to use complicated frameworks. Even if they are helpful, each region has its own strict laws. Switzerland has stringent FINMA control over its DLT Act. Singapore’s Payment Services Act requires licenses and compliance with the FATF Travel Rule, even for companies that work with clients outside of Singapore. This means that startups have to deal with a lot of compliance issues, especially when it comes to following strict rules for checking identities and keeping an eye on transactions, which is similar to how banks do things around the world. To protect themselves from smart contract risk, startups also need to spend a lot of money on technology and security.

These areas are very important since they offer obvious opportunities through defined rules. Businesses can function within set limits because of established legal frameworks and specialized laws. Supportive ecosystems like Zug’s “Crypto Valley” or the UAE’s free zones encourage innovation. The UAE has great tax benefits, such as no capital gains or personal income tax on crypto, which is a huge lure.

Innovation amid crisis

The strain of the economy is what drives innovation. Even though the crypto market is in a downturn, some of the most important crypto trends and technological advances are being driven by the need to cut costs and boost productivity. With capital tightening in 2025, builders are focusing less on token price cycles and more on creating tools, platforms, and assets that solve real problems. Key areas of innovation are:

- Layer 2 Scaling Solutions (Optimistic, ZK-Rollups) that make it easier for people to use them quickly, lower transaction costs by a lot, and make the experience better for users without putting their security at risk.

- Yield-bearing stablecoins are a key part of DeFi since they provide both stability and the chance to make money.

- Tokenization of RWA, including bonds and real estate, makes them more liquid and clear, and it even affects NFT markets.

- AI and blockchain integration are on the rise. Blockchain builds trust by checking the source of AI data and the actions of agents.

The role of community and transparency

During times of market instability, crypto companies need strong governance, community trust, and open communication to stay alive.

Community Trust is a key anchor that helps people stay with the program and stay strong, and it stops people from selling in a panic when prices drop. Regular, honest updates, especially when they provide bad news, stop “ghosting” and boost faith in the team’s capacity to handle problems.

Effective Decentralized Governance (DAOs) encourages community members to share responsibility and be accountable, which makes it possible to make quick, clear decisions about treasury management and changes in strategy.

Future outlook

The market crash on October 11, 2025, when more than $19 billion worth of assets were sold off (a new record) and the Crypto Fear and Greed Index fell to 27 (Fear), showed how sensitive the market is to macroeconomic factors like interest rates and tariffs, and how dangerous it is to borrow too much money.

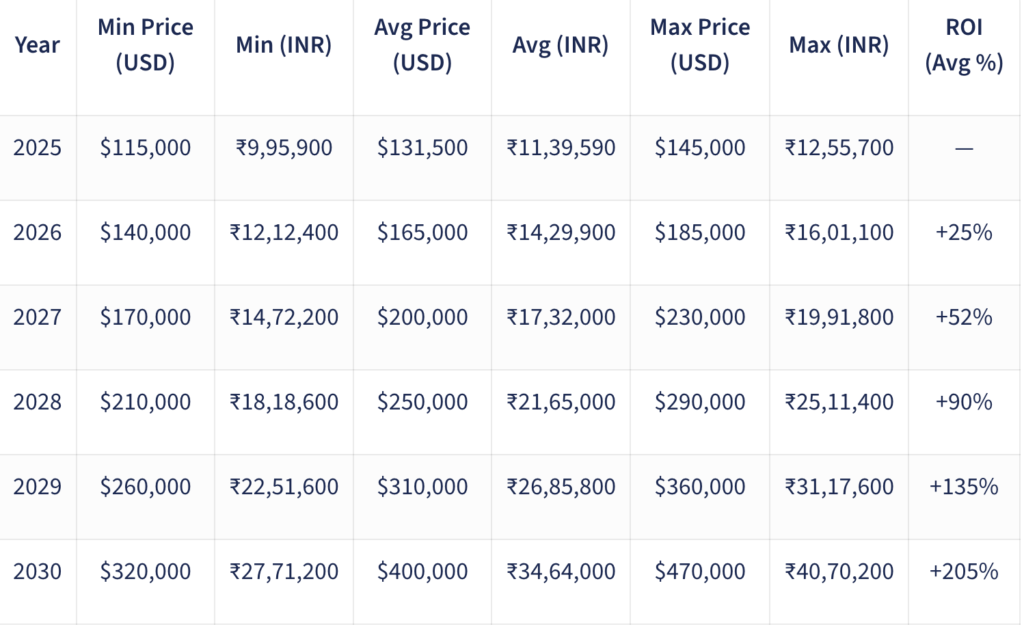

Looking ahead, crypto is maturing into a regulated, institution-driven market increasingly linked to traditional finance. Short-term volatility will persist, especially for altcoins, but long-term growth is supported by adoption, infrastructure, and practical use.

In the near future (late 2025 to 2026), there is a possibility for another upward surge after the April 2024 halving and recent recovery. 2026 will be a slower, institution-led bull year. ETF-driven inflows should stay disciplined, and possible central-bank rate cuts could provide liquidity. Regulation will become stricter and more clear.

By 2026 and beyond, DeFi should grow with the help of frameworks like the EU’s MiCA, which will make it more scalable and interoperable. AI-crypto convergence will lead to contracts that use AI, improved ways to find fraud, and AI marketplaces that are not controlled by any one person. As big banks test on-chain settlement, the use of Real-World Asset tokens is likely to rise.

Over the long run, adoption might make Bitcoin a key asset over the next ten years. All predictions depend on rules, new technology, and how people feel about the market.