What The FTX Collapse Means For Crypto Marketers

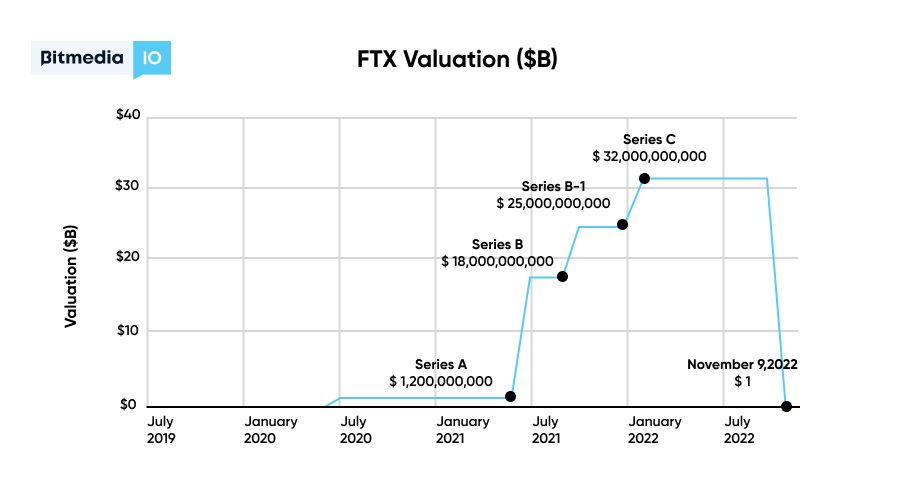

In a matter of two weeks, FTX went from being the fourth-largest cryptocurrency exchange to filing for bankruptcy. Its CEO and head, Sam Bankman-Fried, popularly known as SBF, has now resigned, and dozens of related companies have filed for bankruptcy. The collapse of one of the fastest-growing crypto exchanges in the world has stunned everyone in the crypto space.

What Happened With FTX?

SBF and FTX have been the face of US crypto market, working closely with the government on crypto regulation. The crypto exchange has successfully brought legitimacy to a space long feared by regulators, and by sudden turn of events, also became the force that introduced more questions to the security within the industry.

So is now the perfect time for crypto marketers to start marketing their blockchain products and services, or should they hold off until crypto is back in greens?

A Brief History of FTX. What is Alameda? How Are These Companies Related to Binance?

With headquarters in the Bahamas, FTX was one of the largest cryptocurrency exchanges Sam Bankman-Fried ran. He is also the founder of Alameda Research, a trading firm led by his ex-girlfriend Caroline Ellison. But how are these companies related to Binance?

Binance is the largest crypto exchange run by billionaire Changpeng Zhao. Moreover, Binance was an early investor in FTX. Both companies have built their businesses around risky trading options that are illegal in the United States. But that’s not the only way FTX and Alameda Research relate to Binance. Taking a deeper look at the on-chain data, it is evident that FTX and Alameda Research have been using Binance as an unsuspecting intermediary to transact funds between each other.

How Crypto Exchanges Can Reach New Clients?

The collapse of the fourth-largest cryptocurrency exchange has shaken the cryptocurrency market and finance in general. But this is not the time to cut the marketing cost; it’s time to double down. As FTX clients are feverishly transferring their assets to other wallets and exchanges, this might be the perfect opportunity for other crypto projects to attract new customers.

However, the crypto winter has altered how crypto projects would be marketed, at least for the short term. To give people a better sense of security, crypto brands need to advertise more like the institutions they aim to replace.

With FTX out of the picture, we believe now is the right time for other crypto exchanges to make a statement. Considering the current market sentiments, an active advertising campaign and guaranteed security of clients’ assets are the keys to the success and growth of any crypto business.

Dwelling further into the marketing side of things, crypto ad networks like Bitmedia are the most effective solution for instant conversions in any market climate! Bitmedia is a crypto advertising network that distributes banner marketing campaigns across over 7000 different publications. Furthermore, crypto ad networks enable you to use advanced targeting options like geos, ad reruns, frequency caps, and white and black lists. So, you can significantly increase your return on investment (ROI) and brand exposure in the most cost-effective way! Here are some of the ways you can market your crypto brand and build trust among users:

- Do content marketing

- Increase brand awareness

- Collaborate with well-known influencers, bloggers, and opinion leaders in your niche

- Don’t hide the state of affairs (situation) from your clients

- Make yourself known on social networks

- Be recognizable among clients and partners (give interviews, share expert opinions, participate in market research)

All this will help your company gain more trust and loyalty from your existing and potential customers.

KOL – Why is it Important Nowadays?

The first signs of trouble came on November 2, when a CoinDesk investigation revealed grey schemes between FTX and Alameda Research. Evidently, Alameda Research held large amounts of FTT tokens on its balance sheet. So, people started questioning if part of their balance is functionally their own token.

But things didn’t spiral south until the head of the largest crypto exchange Binance shared plans to sell its share of the FTT tokens. Changpeng Zhao, known as CZ Binance, said, “Due to recent revelations that have come to light, we have decided to liquidate any remaining FTT on our books.” The businessman explained the decision by his unwillingness to support “people who lobby against other industry players behind their backs.”

Around the same time, Alameda’s CEO tweeted that the balance sheet did not give the complete picture, and they had $10 billion in assets that were not reflected on it. But CZ had already announced abandoning FTT tokens, which resulted in people withdrawing over $5 billion worth of crypto from FTX. Unsurprisingly, FTX didn’t have the liquidity, and it ended up halting customer withdrawals.

Then on November 8, SBF tweeted about agreeing with Binance to do a transaction that will protect its customers. No one knew what that meant until CZ tweeted about signing a “non-binding LOI” to acquire FTX fully. The news came as a temporary relief for investors as they thought at least Binance was there to save FTX’s sinking ship.

And then, on Wednesday, Binance tweeted, “As a result of corporate due diligence, as well as the latest news reports regarding mishandled customer funds and alleged US agency investigations, we have decided that we will not pursue the potential acquisition of FTX.com.” That’s basically when things went from bad to worse.

This is why key opinion leaders (or KOLs) are essential. For most consumers, authenticity comes first when deciding on the companies they will support. For instance, in the recent debacle, FTX was not shooting for the stars after the CoinDesk investigation revealed questionable schemes in their balance sheet. However, CZ’s Twitter stories acted as a catalyst, leading people to feverishly withdraw their cryptocurrencies from FTX, causing the collapse of a big company.

What Will Happen With the Crypto World After the FTX Implosion?

Since its rise, the crypto industry has faced a lot of trouble convincing regulators and investors that it’s trustworthy. Now, with the fall of FTX, a company that seemed more stable than others, it would likely strain the industry. Furthermore, the pullout by Binance greatly reflects the current state of things in the crypto world. “The number of entities with stronger balance sheets able to bail out those with low capital and high leverage is shrinking in the crypto ecosystem,” says JPMorgan strategists.

While it’s difficult to determine all victims of the FTX collapse, there are apparent ripple effects in the crypto market. As FTT price fell over 80%, two of the biggest cryptocurrencies, Bitcoin and Ether, plummeted by 65% and 20%, respectively. Also, the price of Solana plummeted on reports that Almeda Research had significant holdings. Even stablecoin Tether USD (USDT), which was supposed to be a safe place to store cash, broke its one-to-one peg to the US dollar. In addition, another crypto lending platform announced suspending customer withdrawals.

However, the cryptocurrency and blockchain sectors can still thrive long-term. The massive collapse of FTX has given the industry an opportunity to improve and learn through trial and error. But the turn of events will undoubtedly lead to further regulatory scrutiny of the crypto industry. We will likely see a reset in the increasing investments and interest in crypto from investment banks and other actors in traditional finance.

Promote your crypto exchange!