Summary of the Year 2023 in Crypto World

As the year ends, the crypto market can reflect and say, “What a year it has been!” Indeed, it’s been a busy 365 days for digital coins, with some significant price fluctuations, legal issues, shutdowns, and even collapses. We’ll look at all of these and other major events in the cryptocurrency space in 2023. You’ll find the news insightful if you’re a member of this global space with a market cap of over $1.70 trillion. They’ll provide some direction on what to expect as we all enter the new year, 2024.

Crypto Chronicles 2023

A lot has happened in the crypto world in 2023. We at Bitmedia.IO have highlighted some of the most significant events related to the crypto industry that took place during this turbulent year.

Below are all the top stories in case you missed any.

Bitcoin Hit an Annual Low $16,680

The king of the crypto space, Bitcoin, hit its lowest value at the start of the year. On January 2nd, the coin’s value dropped to $16,680. Many experts expected it, as BTC has recorded lower rates up to 2023. Specifically, the price of Bitcoin went from over $20,000 in October 2022 to about $16,400 and $16,600 in November and December 2022, respectively.

When the Bitcoin price hit $16,680, some holders feared that with the king of the crypto market down, 2023 could be a bullish year. However, it didn’t take long for things to improve. The number one digital coin ended the month of January on a better note, as the average price across the 31 days was over $22,840. Interestingly, the price has only increased by the month since then.

In February, BTC did an average of around $23,500 in price; by March, Bitcoin was worth over $28,000. Things tended to slow down during August and September, but in October, the Bitcoin price recorded another spike and has remained in an upward trend as 2023 comes to an end.

SEC Shut Down Kraken’s Staking Program

Crypto stakers must have feared for their investments in February 2023. That month, the case of the SEC against Kraken reached its peak, and the commission emerged victorious. The popular exchange had no choice but to shut down its staking service. Additionally, Kraken has to pay $30 million in settlements.

What led to the shutdown? Well, according to the SEC, Kraken failed to provide proper disclosures to users about how it safeguards their staked assets. Specifically, the SEC chair Gary Gensler indicated that staking providers out to register their services with the commission. In his words:

“When a company or platform offers you these kinds of returns, whether they call their services ‘lending,’ ‘earn,’ ‘rewards,’ ‘APY,’ or ‘staking,’ that relationship should come with the protections of the federal securities laws.”

Following the settlement, the widespread consensus in the crypto world was that it was only the start. More exchanges could come under pressure from the SEC. That wasn’t the end of their legal battle with the SEC for Kraken. The Federal Commission once again sued the crypto exchange in November 2023 on the grounds of conducting unregistered operations.

Collapse of Silicon Valley Bank

One of the most riveting crypto news 2023 was the fall of the Silicon Valley Bank. The bank has been long-standing since 1983, but everything came crashing down following a bank run on the 10th of March, 2023. It was the third-largest bank failure in US history, with $209 billion in assets. Two days later, Signature Bank in New York also collapsed.

Both Silicon Valley and Signature Bank had many crypto companies as customers. As a result, their collapse sent ripples throughout the cryptocurrency industry. One crypto firm, Circle, reported losing $3.3 billion out of their USDC reserve at the bank. This news mainly affected USDC, the second-largest stablecoin at the time.

Usually, stablecoins peg their rate to that of fiat—like USDT with the USD. Hence, they serve as safeguards for crypto investors who seek to avoid the volatile nature of the market. But with the Silicon Valley Bank collapse, USDC couldn’t maintain its position as equal to the USD. At one point, the coin was exchanged at 0.89 USDC for $1.

Arbitrum Launched Its ARB Token

While things were rough for USDC in March 2023, ETH recorded a significant development. This happened following the launch of ARB, a governance token by Arbitrum. For emphasis, Arbitrum is one of the largest layer-2 scaling solutions on the Ethereum network.

The scaling solution launched the governance token on March 23, airdropping 12.75% of its supply. Early supporters of the platform got 11.62%, while 1.13% went to developers. After the launch, over 625 thousand wallets got the airdrop, and the token price kicked off at $3.99 on Uniswap.

Many other exchanges featured different prices. Notably, Bybit listed the token for as high as $14. On average, users got up to 625 ARB worth between $625 and $1,250 due to the varying prices. The launch also saw Airbitrum transform into a Decentralized Autonomous Organization (DAO). Consequently, holders of ARB could vote and make improvement proposals regarding the progress of the Airbitrum project.

SEC Filed Lawsuits Against Both Binance/CZ and Coinbase

On the 5th of June 2023, crypto investors woke up to one of the most unsettling news to hit the industry this year. Information from the SEC confirmed that the commission had filed 13 charges against a big player in the crypto field – Binance. Changpeng Zhao (CZ), Binance’s founder, was also involved in the lawsuits. A day after, on the 6th of June, the SEO also unveiled its lawsuits against Coinbase. So, in June 2023, the SEC filed charges against the two largest crypto exchanges in the world in terms of market cap.

The SEC vs Binance case was straightforward. Binance uses Binance.us for its users in the United States and is obliged to restrict them from using Binance.com, the international site. However, the SEC claimed that Binance and CZ failed to keep to the agreement. The commission alleged that the crypto exchange allowed US residents to use Binance.com. Another issue was that Binance sent user funds worth billions of USD to a European company managed by CZ.

On the other hand, the lawsuits against Coinbase were due to unlicensed buying and selling of crypto asset securities. The SEC highlighted the Coinbase staking program, which the exchange failed to register. This was similar to the issue that led to the end of Kraken’s staking program in February.

BlackRock Filed for a Spot Bitcoin ETF

2023 saw BlackRock, the world’s largest asset manager, take a major interest in the crypto world. The company filed an application for a Bitcoin exchange-traded-fund (ETF) in June 2023. BlackRock applied using Coinbase for market pricing and custody.

The news of BlackRock filling for a spot Bitcoin ETF was huge for the crypto industry because nothing has been permitted in the United States. So, it would be the first of its kind. However, the proposal required SEC approval, which is yet to be given.

As of December 2023, the asset management company updated its application to accommodate cash redemptions to secure SEC approval. The previous proposal was limited to only basket redemptions in Bitcoin or “in-kind.” There’s speculation about whether the SEC will eventually approve the spot BTC ETF.

Indeed, the commission has previously approved some Bitcoin futures ETFs. However, it also has records of denying multiple proposals, with the most popular reason being the potential for fraud. Notably, BlackRock is also considering alternatives, as the company filed for spot ETH in November.

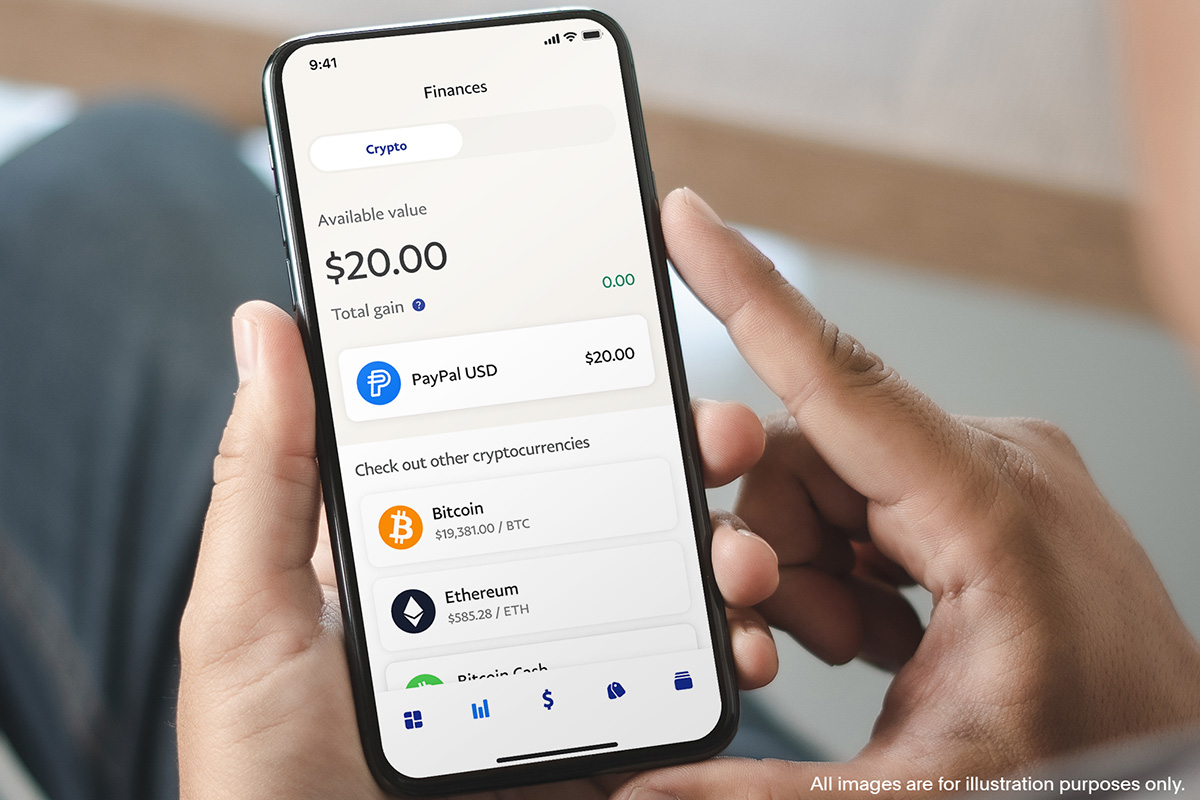

PayPal Launch the PYUSD Stablecoin

The list of stablecoins in the crypto market extended in August 2023 with the addition of PYUSD. Launched by the giant payment and commerce company PayPal, PYUSD (PayPal USD) follows the same path as USDT and USDC. The stablecoin has its price pegged to the US dollar, and it’s the first happening of such nature by a leading financial company in the US.

As expected, PYUSD was exclusively available to PayPal users in the United States upon its launch. In fact, accessibility to the stablecoin requires meeting some eligibility benchmarks for PayPal users. If eligible, customers can use PYUSD to make online payments and money transfers. Additionally, users can directly convert cryptocurrencies supported by PayPal to the stablecoin and vice versa.

It’s worth noting that PYUSD is an ERC-20 token. In other words, it was launched on the Ethereum blockchain. According to PayPal, the stablecoin aims to aid web3 applications, external developers, and wallets in their crypto dealings. Already, many exchanges have listed PYUSD on their marketplaces.

Bitcoin Retakes $44,000

As the crypto year ended, the market king made a substantial price hit. Having reached an annual low of $16,680 in January, the BTC price peaked at over $44,000 on the 6th of December. Building up to that date, Bitcoin had gone from around $37,700 at the start of the last month of the year to approximately $42,000 on 5th December.

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/X5IOTH4H7JA25FAF3XD7C6U4L4.png)

The BTC price declined for the next two days, hitting less than $43,800 on December 7 and going even lower at $43,270 on December 8. However, it was good news for Bitcoin holders again on the 9th of December 2023, as the coin price climbed to $44,200. In the last of the 365 days of 2023, the price of BTC hovers around $43,000.

What’s to expect in 2024?

From the crypto review 2023 news, the industry is clearly ending the year on a strong foot. Market analysts predict a bull run in 2024, and some even conclude that the run has already begun. Among the many predictions, many experts predict the price of BTC to reach $100,000. If history is any guide, once the price of Bitcoin soars, it carries many altcoins along.

What Is the Highest-Rising Crypto in 2023?

The highest-rising crypto in 2023 was Lido DAO (LDO). In 2023, the token saw a price increase of more than 100% during the year’s first half. During the first quarter, the price shot up by more than 225%. The token’s market cap at the end of 2023 is over $2.2 billion.

Which Crypto Will Boom in 2024?

According to experts, Bitcoin, the number one cryptocurrency, is expected to record a significant boom in 2024. The all-time high for BTC is $69,044.77, but predictions are that the coin could reach $100,000 in 2024.

Will Crypto Recover in 2025?

The cryptocurrency market is predicted to record favorable trends in 2025. Major coins like BTC, ETH, BNB, XRP, and LTC are projected to reach high prices.