Crypto Advertising Regulations Explained – What Advertisers and Publishers Must Know

Wherever large amounts of money circulate, be it banking, lending, or digital assets, fraud and scams inevitably follow. Cryptocurrency is no exception.

Chainalysis reports that in 2024, cryptocurrency scams received at least $9.9 billion on-chain. Among them are high-yield investment schemes and rug pulls — types of scams that often reach their victims through advertising. That’s why governments and leading ad platforms are tightening cryptocurrency advertising regulations to protect users.

In this article, we’ll explore which crypto projects are actually allowed to advertise, what crypto ad copy best practices look like, and what risks publishers face when they choose to host them.

Before we begin, let’s define the key players: advertisers (the projects or products seeking promotion), publishers (the websites that host ads), and the end users who see and interact with them.

Publisher responsibilities in crypto advertising

Let’s start with publishers, because they are the ones who set the rules that advertisers must follow in order to be able to advertise. A publisher is any platform, website, or app that provides the space where cryptocurrency ads are displayed.

Here are the types of publishers in cryptocurrency advertising:

- Big tech platforms like Google, Meta, and X

- Crypto-native media outlets such as Cointelegraph, Decrypt, Bitcoin.com, or HodlFM

- Specialized ad networks like Bitmedia, Coinzilla, and CoinTraffic

- Independent blogs, apps, and communities.

It might seem that publishers only have to place the ads. But in reality, it’s not so. They share legal and reputational responsibility for what they publish. Regulators can hold publishers accountable for hosting fraudulent or misleading ads for crypto, even if the publisher wasn’t directly involved in the scam. For example, hosting an ICO ad that promised “guaranteed profits”.

Also, publishers risk their reputation. If a reader clicks a scam ad on a respected crypto news site and loses money, trust in the publisher also collapses.

To prevent all these risks, publishers have to conduct due diligence. It’s a background check that a crypto project or company is legitimate, properly registered, not linked to fraud, and compliant with licensing or disclosure rules. According to this, some publishers even have their own whitelists and blacklists of projects.

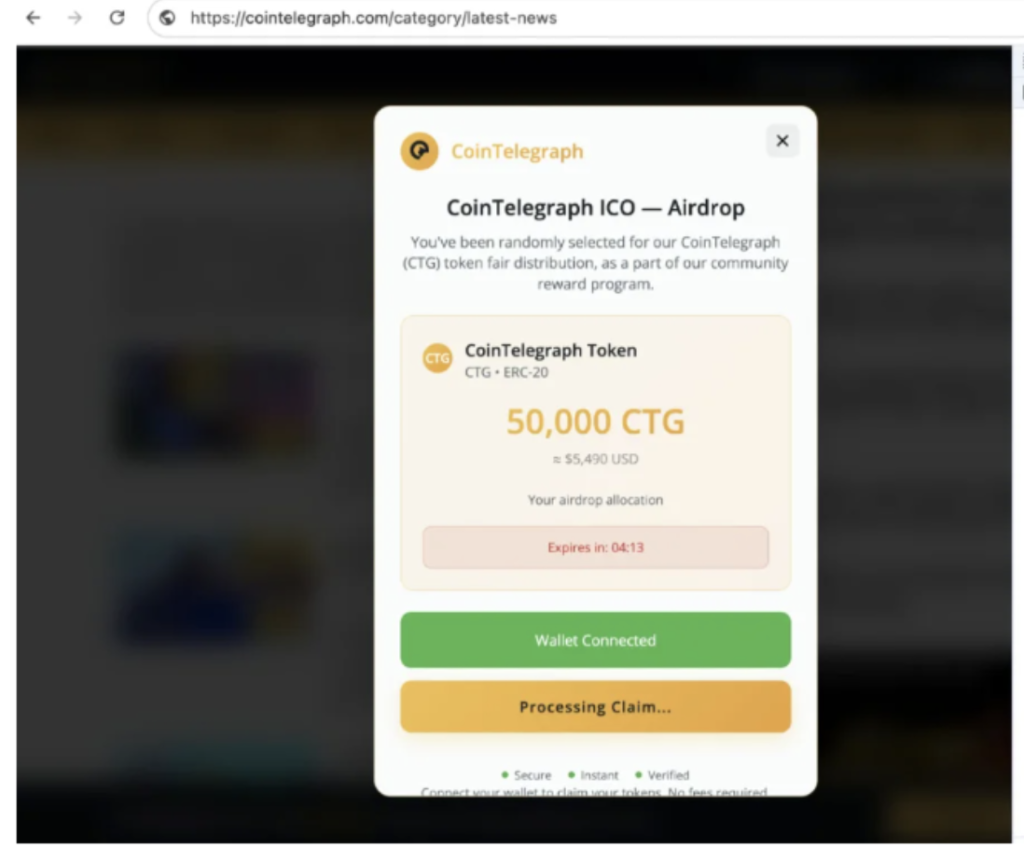

We’ve already seen cases where media outlets published scam advertisements and suffered reputational damage. In June 2025, Cointelegraph was hacked and briefly displayed fake token airdrop ads.

Global crypto ad restrictions in 2025

Google, Meta, and X have different requirements for crypto ads, and it is difficult to keep track of what applies where. In this section, we will go through each of them in turn.

According to Google’s Ads Safety Report 2024, a total of 193.7 million bad ads in financial services, including those related to crypto, were blocked, and another 268.3 million were restricted.

These figures confirm that Google is the strictest platform. It requires businesses to obtain official certification, such as registration with FinCEN in the U.S. or an equivalent regulator abroad, before running crypto Google ads.

If you want to learn more about Google ad policy and Google crypto advertising, read our analysis in this article.

| Allowed | Prohibited |

| Licensed exchanges & software wallets (per country) | ICOs, token sales, DeFi protocols |

| Hardware wallets (certified) | DEX offerings, liquidity pools, crypto loans, unregulated dApps |

| Crypto coin trusts (certified) | Aggregators, trading signals, affiliate sites |

| General crypto services (payments, mining hardware, tax/legal/security, blockchain platforms, education) | Investment advice, broker reviews |

| NFT games (only if NFTs enhance gameplay, not gambling/staking) | NFT games tied to real-world gambling |

Meta (Facebook & Instagram)

Meta is less strict than Google, but still cautious. Most crypto ads on Facebook and crypto ads on Instagram require written approval from Meta before going live.

The platform has strict rules:

- No misleading claims or exaggerated promises.

- Ads cannot target minors.

- No aggressive tactics (spam, pop-ups).

- Influencers/blogs must disclose (#ad, sponsored) and base endorsements on actual use.

A key challenge of Facebook crypto advertising is timing. Many businesses complain that the approval process can take weeks. That’s why campaigns need to be planned well in advance.

| Allowed without license | Require Meta approval |

| Events, education, and news (no buy/sell promotion) | Exchanges & trading platforms |

| Tax services for crypto firms | Wallets with trading/staking features |

| NFTs & non-currency blockchain products | Crypto borrowing & lending |

| Storage-only wallets | Mining hardware/software |

| Non-transactional crypto services (infrastructure support) | Investment promotions, affiliate & aggregator sites |

X (Twitter)

X is the most crypto-friendly among major platforms. It allows a broad range of crypto advertising solutions without pre-approval. However, they must not contain misleading claims.

| Allowed | Prohibited |

| Exchanges, wallets, ATMs, credit/debit cards, staking, tax tools | ICOs, IEOs, IDOs |

| DeFi services: borrowing/lending, insurance, dApps, DEXs | Crypto mining (hardware & software) |

| NFTs, marketplaces, minting tools | |

| Blockchain games (non-gambling, licensed) | |

| Smart contracts & educational content |

X’s Financial Services policy takes into account both whether a project has a national license and its own list of countries that are allowed or restricted from advertising certain financial services.

You might protest — it feels like restrictions on top of restrictions!

In fact, it’s a justified precaution. In the UK alone, in 2024, nearly 90% of crypto registration applications failed to meet the Financial Conduct Authority’s AML and fraud-control standards.

Crypto advertising platforms

Smaller startups often find it nearly impossible to get Google crypto ads approved or run crypto advertising on Facebook. That’s where specialized crypto advertising networks like Bitmedia come in.

These provide direct access to crypto-native audiences — people already interested in the industry. Restrictions are minimal, with bans usually limited to obvious scams or fraud. Approval is fast, and the process is far simpler than on big tech platforms.

It all makes crypto advertising networks especially attractive for smaller or unregulated projects.

| Feature / Rule | Google Ads | Meta | X | Crypto Ad Networks |

| Approval process | Requires official certification | Written approval from Meta | Must follow local laws | Quick review |

| Exchanges & Wallets | Allowed if licensed + certified | Allowed if approved by Meta | Allowed if legal in target country | Widely allowed |

| ICOs / Token Sales | Fully banned | Fully banned | Fully banned | Often restricted |

| DeFi Protocols | Not allowed | Not allowed | Some allowed if regulated | Usually allowed |

| Mining Ads | Prohibited | Allowed with approval | Prohibited | Often allowed |

| Educational Content | Allowed | Allowed | Allowed | Allowed |

| Investment Advice / Signals | Not allowed | Not allowed | Generally not allowed | Sometimes allowed |

| Influencer / Sponsored Posts | Not relevant | Must disclose | More flexible | Actively used |

| Overall Strictness | Strictest | Medium strict | More crypto-friendly | Most open |

How decentralized projects can still advertise compliantly

Let’s assume you’re eligible to advertise on major platforms and crypto ad networks. Now, let’s focus on the ads themselves. There are a number of requirements for what ads should be, or more precisely, what they must not be.

- Transparent messaging

Publishers require product descriptions to be honest and as objective as possible, not overly promotional. Instead of saying in an ad “1000% profit guaranteed”, it’s better to talk about how its governance works, what the token does, and what risks are involved.

Take the example of Uniswap. They succeeded in advertising crypto responsibly. Instead of promoting themselves as an exchange, they built Uniswap University — an educational hub for Web3 learning. The project offers step-by-step lessons, tutorials, and quizzes about topics like swapping tokens, liquidity pools, and risks of losses.

2. Disclaimers and risk warnings

Maybe you’ve already noticed that on all crypto sites, there are disclaimers like “do your own research.” This phrase means that users shouldn’t rely solely on the ad or platform for investment decisions and must take personal responsibility by checking information themselves.

In some regions, such as the EU, projects are even required to state their regulatory status directly. These statements should be added to crypto banner ads and landing pages, for example: “We are registered as a Crypto Asset Service Provider under the supervision of [regulator].”

3. Geographic targeting and regulatory alignment

Not every country views crypto the same way. So why waste time advertising where you’re not allowed? To manage it, projects use geofencing, limiting people from which regions see ads.

This is exactly what Binance did. In the UK, it paused new user registrations in 2023 to comply with the UK Financial Conduct Authority’s (FCA) new ad rules. By contrast, in regions with clearer licensing frameworks, such as the EU (France, Italy, Spain) or Dubai, it has expanded its advertising activities more broadly.

4. KYC/AML implementation

That might sound counterintuitive because the idea of decentralized finance is that it does not require authorization. But since compliance is necessary, many projects now offer hybrid solutions: identity verification for token sales or platform access, while still keeping users’ private activity secure.

For example, Aave, a DeFi lending protocol, launched Aave Arc, a permissioned version for institutions that require KYC checks. At the same time, its main protocol stays open for regular users.

5. Working with compliant partners

Finally, partnerships matter. A decentralized project that teams up with regulated exchanges, custodians, a reputable crypto advertising company or a crypto advertising network gains instant credibility.

Bitmedia’s compliance and fraud-prevention measures

Bitmedia operates under clear agreements for both advertisers and publishers: Advertising Agreement and Publisher Terms. As one of the top players in crypto native advertising, Bitmedia provides manual ad reviews to block scams and ensures publisher protection through strict advertiser verification.

Conclusion

The major platforms follow a similar pattern: exchanges, wallets, and core crypto infrastructure products are usually permitted to advertise. Projects built to solicit immediate funds from users like ICOs, token sales, or lending protocols, remain off-limits for advertising. On top of that, platforms add regional rules and location-based restrictions.

Google advertising crypto requires certification, Meta issues approvals directly, and X, the most lenient, focuses mainly on ensuring ads are not misleading. For projects that don’t want to wrestle with the regulatory requirements of specific countries and platforms, specialized crypto ad networks are an excellent option.

In crypto advertising, responsibility lies with all the parties involved. Publishers must check advertisers, and advertisers, in turn, must create ads that don’t mislead people.

As competition grows, the most successful crypto advertisers won’t be the loudest, but the most trusted by regulators, publishers, and users.